Effective Governance Structures for Real Estate Family Offices

- Published

- Jun 30, 2025

- Share

Owning and managing a real estate company is dynamic. Property and asset managers are focused on making sure portfolios are fully leased, properly maintained, efficiently run, and appropriately financed. Over time, buildings and businesses are purchased and sold, and as activity increases, so does the number of decisions.

For families owning these companies, the primary goal is to make decisions that are right for the business and right for the family. This is where governance, how families decide to make decisions with one another, becomes important.

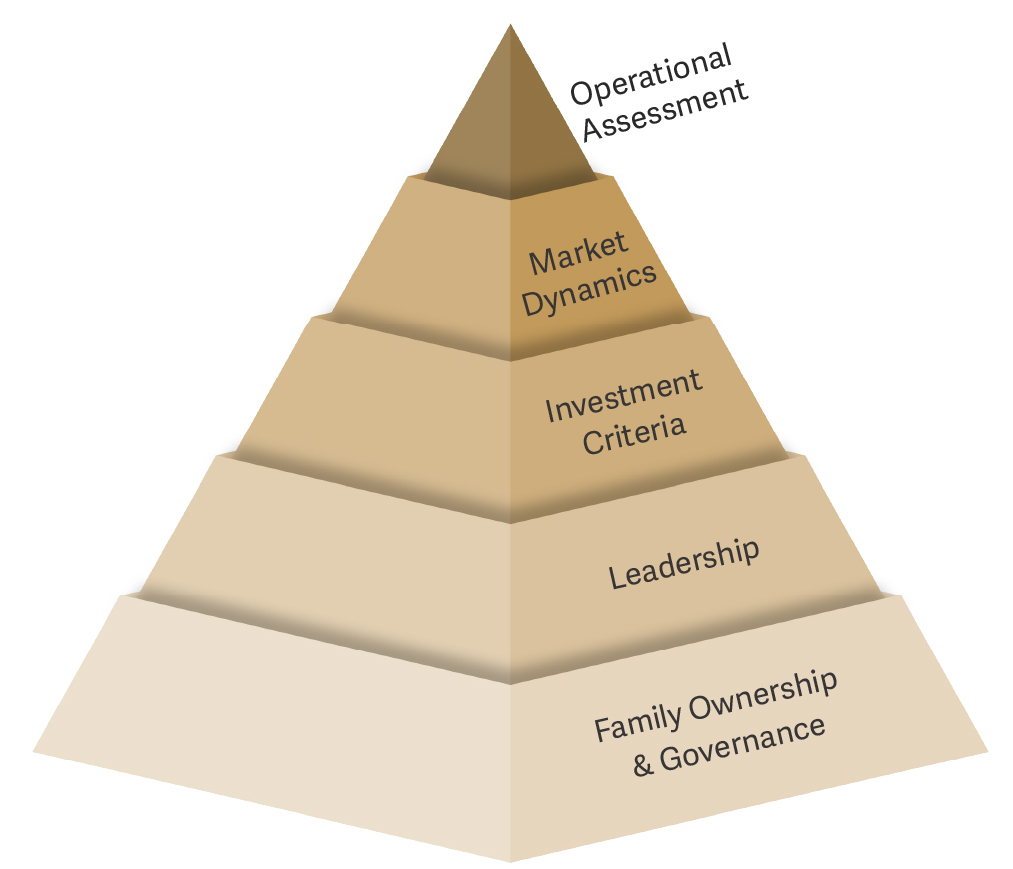

To support families in making critical business decisions, we have created a decision hierarchy. This framework outlines the many factors real estate families should consider when exploring the benefits and risks of growth opportunities.

The pyramid below illustrates not just the typical decision criteria for any real estate investment but also the additional layers in the decision hierarchy that apply specifically to a family-held real estate business.

Understanding Family Goals in Real Estate Investments

Real estate investors usually begin the decision-making process by considering the various investment goals for the project or acquisition, such as the required risk-adjusted return. However, in a family business with multiple owners, decisions often start with a more fundamental set of criteria: understanding the goals of the family involved in the real estate enterprise.

The Role of Governance in Family Businesses

How families make decisions when they are in business together is called governance. Often in family real estate enterprises, the founder’s governance might be as simple as “What I say goes,” which can be efficient and agile. However, as the family expands, decision-making becomes more complex. Establishing a clear process for making joint decisions and fostering transparent communication is vital for future success.

Aligning on Risk Appetite, Investment Policy and Education

A family might have similar views on risk, or certain family members may be willing to aggressively invest for higher returns, while others want to invest to maintain liquidity and stable distributions conservatively. Through open dialogue, family members can proactively create an investment policy that aligns the group’s thinking on risk appetite.

Inclusive of the conversation around risk, a level playing field of education so that each member understands the components being discussed helps move the needle on these areas that seem so divisive. When we talk about investment in real estate, we need to make sure that family members are clear about relative portfolio value, to leverage and cashflow. These vary in real estate families differently from other family enterprises.

Family leaders should also be aware of the impact of changing distributions on family members. While no single family member should halt decision-making, a formally created investment policy can significantly reduce disputes and make investing more efficient.

Assessing Leadership and Management Capabilities

As family ownership grows, the needs of the business also grow. It’s important to consider whether current leadership has the experience, runway, and appetite to integrate the future direction with existing company activities and the ability to maximize returns.

When to Consider Outside Management

At some point in the growth curve, the number and complexity of issues to be dealt with may benefit from outside management. This is particularly relevant if the company moves into a new strategic direction, such as:

- A different property type or market

- Starting a fund

- Moving beyond equity ownership into creating a debt platform

Bringing in a non-family manager is a significant decision. We advocate for creating a detailed position early on. This makes sure that the role dictates responsibilities and that evaluations are based on performance rather than performance factors. Family members should carefully and collectively assess whether current management's skill sets align with the competencies required to run the growing business and manage its risk effectively.

It’s not an all-or-nothing scenario. A healthy mix of family and outside leadership often brings fresh perspectives to the organization, while keeping the owners firmly in control.

Navigating Financial and Ownership Structures

Additional considerations for real estate family investments include:

- How the new investment entities will integrate with existing estate and trust planning

- How ownership will be divided among the family members

- Which family members will be required to contribute capital to the venture

A particularly relevant concern for certain family members is whether there will be any disruption to current cash distributions to fund the growth. Though at times a tricky subject, distributions are best coordinated with a conversation about a reinvestment policy. It makes sense that owners receive a distribution because their capital is at risk, but not at the expense of the business's functioning. This is where education for shareholders and owners is key, so owners understand their rights and responsibilities.

Establishing Investment Criteria and Market Analysis

Once the foundational criteria have been established, the more usual investment process begins. In addition to return requirements, the family can create established investment criteria through their governance process, which includes components such as:

- Acceptable time horizons

- Willingness to include non-family member capital

- Leverage limits

These metrics will take into account the family’s comfort with where to invest in the real estate lifecycle:

- Development

- Construction

- Transitional properties

- Stable properties

Additionally, the family may be more familiar with particular property types and choose to stay with what they know.

Assessing Market Conditions

The next level in the decision hierarchy is the state of the market(s) in which the family will invest. The first consideration is whether the investment will be made:

- In a down cycle

- In a well-advanced up cycle

- Somewhere in the middle

The market cycle position will inform both acceptable pricing and required risk-adjusted returns. Depending on the type of growth strategy, the due diligence program should include a detailed look at supply-and-demand trends, measured not only in rent and occupancy, but in the competitive landscape and the pipeline of potentially competing projects.

Optimizing Operational Readiness for Growth

Moving from external to internal considerations, the family should assess whether its operational platform is ready for growth. Operations include:

- Staffing levels

- Management and asset management procedures and systems

- Accounting and reporting

We encourage families to candidly evaluate the capacity of each of these functions to take on the new project, portfolio, or business, including a review of the adequacy of the company’s control environment. Of particular importance is having the analytical capability and skill sets to forecast investment profitability reasonably.

Building a Lasting Legacy

Real estate is a unique business, and the process for investing in growth is dynamic and full of opportunities, especially when the business is family-owned. The goal is to successfully grow the business while using the family’s wealth to enrich their lives through legacy and cohesion and through shared ownership and education that can last throughout generations.

Transparency throughout the due diligence process, including reports on the opportunity and how management leads the company through the decision hierarchy, is a critical success factor in maintaining profitability and family harmony.

Interested in exploring how a well-defined decision hierarchy and strong governance can benefit your family's real estate ventures? Schedule a call with one of our professionals to learn more.

What's on Your Mind?

Start a conversation with Natalie